29th January 2026

The 'inverted pyramid': winners from new US food guidelines

The US government’s action to shift the national diet towards nutrient-rich foods provides tailwinds for companies in ‘real food’ supply chains and reformulation

Key points

- Revised US government guidelines emphasise high-quality proteins, dairy and fats as the basis of a healthy diet

- The policy shift will directly raise nutritional standards for school meals and reshape how 'food stamps' can be spent

- We believe the changes provide a powerful tailwind for leading providers of products and services that enable healthier diets

- Revised US government guidelines emphasise high-quality proteins, dairy and fats as the basis of a healthy diet

- The policy shift will directly raise nutritional standards for school meals and reshape how 'food stamps' can be spent

- We believe the changes provide a powerful tailwind for leading providers of products and services that enable healthier diets

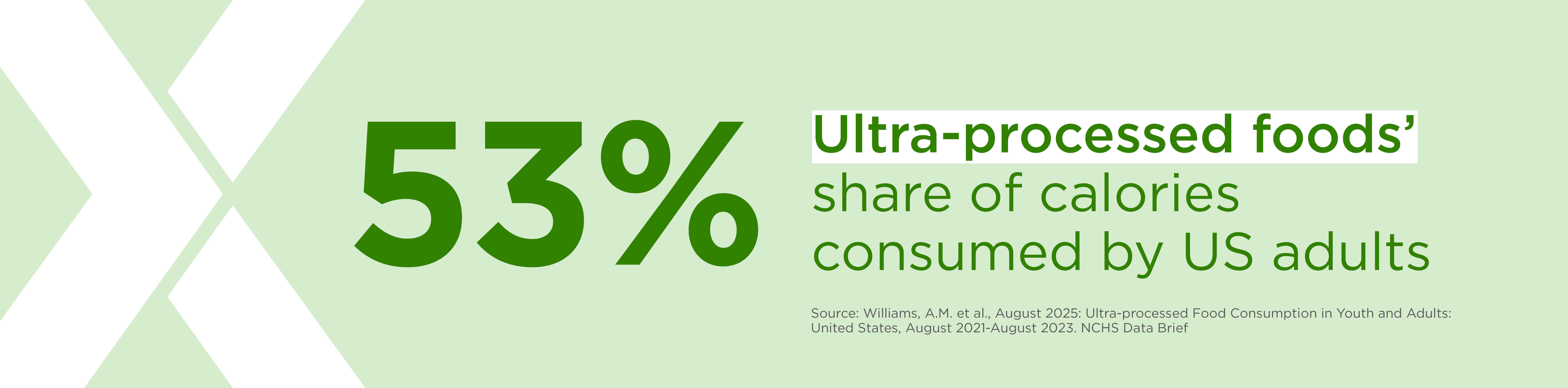

The start of 2026 marks a significant pivot in US federal nutrition policy. By placing 'real food' at the centre of new dietary guidelines, the US government is signalling a clear intent to shift the national diet away from energy-dense products and towards whole, nutrient-dense alternatives to ultra-processed foods (UPFs), which account for 53% of calories consumed by US adults.1

For investors, the ramifications of this policy shift are far-reaching, with the government effectively seeking to direct both consumer behaviour and billions of dollars in institutional food purchasing.

As public institutions and consumers adjust to these new standards, we believe that companies with established capabilities in 'real food' supply chains and reformulation technologies stand to benefit disproportionately from the transition.

Turning decades of nutritional policy on its head

To understand the magnitude of this shift, it is necessary to look back at the US Department of Agriculture's (USDA) original Food Guide Pyramid.

This 1992 guidance - which has served as the cornerstone of American nutrition for a generation and influenced subsequent iterations, including the recent 'MyPlate' tool - effectively prioritised refined carbohydrates over nutrient-dense proteins and healthy fats. The pyramid was built on a foundation of six to 11 daily servings of grains, such as bread, cereal, and pasta. Fats and oils were relegated to the very tip, to be used only sparingly.

The 2025-2030 Guidelines represent a near-complete reversal of that logic. In the new 'inverted pyramid' framework, grains have been moved to the smallest section at the bottom, while high-quality proteins, full-fat dairy and healthy fats now form the primary focus of a healthy diet. This change reflects a broader mandate from Health Secretary Robert F. Kennedy Jr. for Americans to "eat real food".2

The most significant aspects of this reset are found in the specific, measurable targets now being set, including:

Protein: The new guidelines recommend a daily intake of 1.2 to 1.6 grams of protein per kilogram of body weight.

Sugar: The government has effectively declared a 'war on added sugar' by replacing the vague "10% of total daily calories" recommendation with a hard limit of no more than 10 grams of added sugar per meal.3 Crucially, the guidance suggests that no added sugar is considered part of a healthy diet for children under four.

Fats: The new recommendations endorse whole-food sources of fat, including full-fat dairy, eggs and red meat, as essential components of a nutrient-dense diet.

Source: Williams, A.M. et al., August 2025: Ultra-processed Food Consumption in Youth and Adults: United States, August 2021-August 2023. NCHS Data Brief

The reach of the new guidelines

While consumer trends often take years to shift, the impact of these guidelines will be felt immediately through the vast mechanism of federal nutrition policy. The guidelines are not merely suggestions; they serve as a mandatory blueprint for how billions of dollars in public food expenditure should be allocated.

The most significant ramifications are likely to directly manifest in two key areas, before influencing standards across the broader US market.

School nutrition: These guidelines dictate the menus for approximately 30mn schoolchildren. UPFs currently make up nearly two-thirds of the caloric intake for the under-18s.4 We expect federal standards for school meals to be rewritten to prioritise high-quality protein and full-fat dairy while strictly limiting added sugars.

Public assistance: The Supplemental Nutrition Assistance Program (SNAP) currently supports 42mn low-income Americans, 78% of whom also receive health coverage through Medicaid.5 The government therefore has a clear financial incentive to shift how 'food stamps' are spent away from unhealthy food products that are associated with obesity and other health issues.

Structural winners from the 'real food' shift

Since the US accounts for nearly 30% of worldwide food spending, this policy shift could have a material impact on the opportunity set presented to the global food sector.6

In our view, it stands to accelerate the transition towards healthier, more nutrient-rich diets that is already underway. We believe that it therefore supports opportunities in five specific areas:

- High-quality protein. We expect the significant increase in recommended protein consumption to benefit high-quality aquaculture and dairy producers. This aligns with public health and wellness concerns and the rising penetration of GLP-1 weight loss drugs. Leading farmed salmon producers such as Norwegian-listed Lerøy and Bakkafrost are well-positioned, in our view, as the guidelines specifically endorse omega-3 rich seafood.

- Fresh produce. As the pyramid is essentially inverted to prioritise fruits and vegetables, we expect a long-term tailwind for market-leading producers like Dole.

- Herbs and spices. As Americans are encouraged to reduce sodium and added sugars, herbs and spices become essential tools for maintaining flavour in 'real food' meals. The likes of McCormick, a US-based spice and seasoning manufacturer, should be significant beneficiaries of this shift, in our view.

- Fermented foods and gut health. For the first time, US federal guidance explicitly endorses fermented foods like kefir, sauerkraut and miso. We believe that market leaders including French-listed Danone (yoghurts) and Danish-listed Novonesis (specialised cultures and enzymes) should be well placed to benefit from this new focus on microbiome health.

- Reformulation. Food manufacturers face a massive task in stripping added sugars from existing products. To overcome the technical challenge of meeting stricter limits while maintaining taste, many food manufacturers partner with specialist ingredient companies like Irish-listed Kerry, which has a particular focus on food product reformulation.

A structural pivot for US food policy

The USDA's revised guidelines signal a new direction of travel for the US food market. Given their potential to transform how US food spending is allocated, these policy changes cannot be overlooked by the global food industry - and investors in it.

By raising nutritional standards in a market currently dominated by UPFs, we believe the changes provide a powerful tailwind for leading providers of products and services that enable healthier diets.

1 Williams, A.M. et al., August 2025: Ultra-processed Food Consumption in Youth and Adults: United States, August 2021-August 2023. NCHS Data Brief

2 White House, January 2026: Press Secretary Karoline Leavitt Briefs Members of the Media, Jan. 7, 2026

3 US Centers for Disease Control and Prevention, January 2024: Get the Facts: Added Sugars

4 Williams, A.M. et al., August 2025: Ultra-processed Food Consumption in Youth and Adults: United States, August 2021-August 2023. NCHS Data Brief

5 US Department of Agriculture, January 2026: Trump Administration Resets U.S. Nutrition Policy, Puts Real Food Back at the Center of Health

6 Impax analysis, January 2026. Based on US food spending data from the US Department of Agriculture (2024) and estimates of global food spending data from Statista (2024)

References to specific securities are for illustrative purposes only and should not be considered as a recommendation to buy or sell. Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management's views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment